2025 Letter to Stockholders

Through both good and bad markets, our goal at XOMA Royalty is to remain focused on generating value for shareholders through solid execution, wise capital deployment, and deal creativity. As we look to the remainder of 2025 and beyond, we believe we have established a solid foundation for future growth.

2024 Letter to Shareholders

We made good progress over the course of 2023 towards advancing the company’s differentiated royalty business model. As is the case with any emerging biotech portfolio, there were both positive and negative developments, although many of our key near-term drivers of value remain intact.

XOMA raises up to $140M with Blue Owl Capital

“The Blue Owl financing provides us with significant non-dilutive capital to drive shareholder value through stock repurchases and additional royalty and milestone acquisitions,” stated Brad Sitko, Chief Investment Officer of XOMA.

2023 Letter to Shareholders

Since joining the Company in January 2023 as Executive Chairman and interim CEO, I have come to better appreciate the opportunity presented by XOMA’s unique business model and seasoned team, and equally important, the optionality embedded within our growing royalty and milestone portfolio.

Chairman’s 2022 Year-end Letter

As 2022 comes to an end and my retirement begins, I take this opportunity to ask you to look forward and see what I see – XOMA, the Royalty Aggregator for biotech companies.

Biotechs look to sell royalties to raise cash in a tough market (Financial Times)

Biotechs are turning to specialist royalty companies to generate cash from future sales of their products, as they try to survive a dramatic sell-off in the sector.

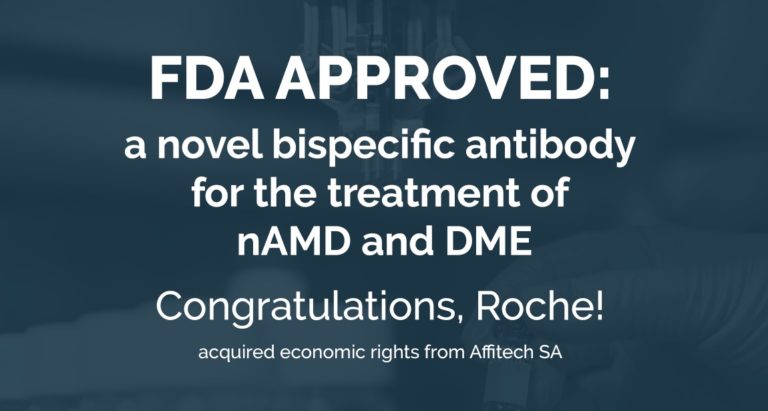

EC Approved: VABYSMO® (faricimab-svoa) for the Treatment of nAMD and DME

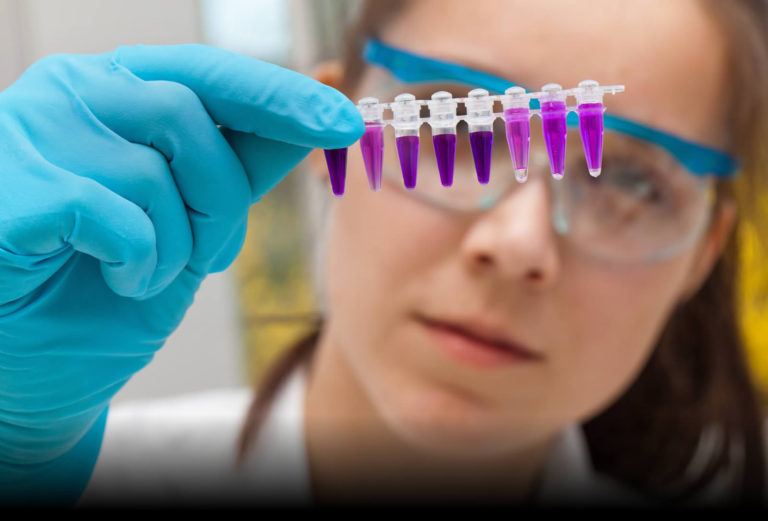

We are happy to inform you of the recent news about the European Commission (EC)’s decision to grant approval for VABYSMO® (faricimab-svoa), Roche’s novel bispecific antibody for the treatment of neovascular or wet age-related macular degeneration (nAMD) and visual impairment due to diabetic macular edema (DME).

2022 Letter to Stockholders

XOMA’s milestone and royalty aggregator business model began to demonstrate its potential in 2021 and the first few months of 2022. There are two key value driving elements to our strategy. One is to let the assets advance in the hands of the development partners, and as they experience success, the asset value to XOMA increases. The second is to acquire assets to continue growing our portfolio of potential milestone and royalty economics and further mitigate the risk associated with any single asset. The value of both elements were on display in 2021 and continue to show their impact in early 2022.

FDA approves Roche’s novel bispecific antibody for treatment of nAMD and DME

FDA approves Roche’s novel bispecific antibody for the treatment of neovascular or wet age-related macular degeneration (nAMD) and diabetic macular edema (DME), representing XOMA’s first portfolio asset to receive FDA approval.

2021 Year-end Letter to Shareholders

As we close out 2021 and look forward to all the possibilities 2022 will bring for XOMA, it seems appropriate to reflect on how much progress has been made by both our partners and our team. Today, within the XOMA portfolio of over 70 potential milestone and royalty assets, we have several programs that our partners have advanced into late stages of development.

XOMA Purchases Commercial Payment Rights to BLA-Review-Stage Asset

Today we announced an important transaction for XOMA. We purchased the rights to a 0.5% commercial payment stream in a BLA-review-stage asset – faricimab –

2021 Letter to Shareholders

For many of us, 2020 was a tale of two halves. The first half of 2020, COVID-19 hit and brought significant uncertainty to every aspect of our lives. We had to adapt and change how we lived and worked, unclear of when this uncertainty would end and when we could go back about our lives and our routines.

XOMA: The royalty aggregator that thinks like a biotech

By Guy Martin For biotech companies, the prospect of receiving non-dilutive, non-recourse funding to advance their assets even through the early stages of clinical development

2020 Annual Meeting of Stockholders

Full audio recording of XOMA’s 2020 Annual Meeting of Stockholders

2020 Letter to Shareholders

Everyone at XOMA hopes this letter finds you well. We collectively are experiencing a global event that few could have anticipated. It makes us remember what’s most important in life – our health, our families, our colleagues, and our friends. For our 10-person team, XOMA not only represents colleagues and friends, we also feel that XOMA is part of our family.

CEO Letter – First Half 2019

In the first half of the year, there are have been some exciting developments for XOMA. Many of these events were communicated to the market by our license partners, which then provides us the opportunity to communicate in more detail with you. To this point in 2019, we have seen significant clinical advancement and received the first glimpses into the potential therapeutic value of several XOMA legacy partnered assets. And what we have seen is exciting!

XOMA Congratulates Rezolute on its Successful Financing and Progress Towards Initiating Phase 2b Study for RZ358

Rezolute intends to commence Phase 2b study for RZ358 later this year, in conjunction with its recent completion of a $45 million investment round. XOMA received a $2.9 million milestone payment related to the completed financing.